Taking up a home loan is a significant contract. Whether you are a primary-go out homebuyer, exchange upwards, or refinancing your current household, you desire a lender you can rely on. We are here to produce the newest rely on you would like in virtually any housing market.

The mortgage manager is an important part of one’s group for your homebuying travel. They have been the guide because you browse the latest homebuying procedure, making it vital that you see he’s got the back-especially when you are considering working for you choose the right loan on lowest price and you may fees. Won’t your instead companion that have anyone whoever efforts are to suffice you, perhaps not the lending company they work having?

Progressively more Us americans consent, that’s the reason more folks opting for to invest in their houses by way of borrowing from the bank unions as opposed to financial institutions. Borrowing unions added more than 20 billion participants over the past five years, if you find yourself borrowing from the bank commitment mortgage originations increased more 71% when you look at the 2020.

Resource a property as a consequence of a credit partnership isn’t only regarding the delivering a minimal possible rate of interest-whilst the national mediocre rates getting borrowing unions sounds away financial institutions into the pretty much every sorts of home loan and you may domestic security financing. Borrowing from the bank unions promote a myriad of most other benefits that can assist your flourish in your second home.

As to why borrowing commitment mortgage loans be more effective

During the OCCU, our users started to united states expecting top provider, down rates of interest, and you may lower or no charge. Across the lifetime of a mortgage loan, all those things accumulates to large coupons for you. So just how can we offer these types of perks?

Everything comes down to the fresh center credit connection difference: We have been possessed and you will ruled of the our players (you). Not only are you willing to reach choose for the officers and administrators just who establish our formula, however, due to the fact do not need to worry about generating earnings for buyers, we’re able to ticket our very own payouts back since savings on the home loan or other financial attributes.

The professionals-basic thought is the reason why the financing connection homebuying feel dramatically diverse from taking a timeless lender mortgage loan. As opposed to a lender, which is mainly wanting increasing earnings to own investors, your borrowing from the bank connection truly desires one make it with your home loan. You’re not simply a customer so you can all of us. We’re your financial lover on the path to homeownership, and your achievements was an immediate meditation off how good we have been helping your.

Make it easier to choose the best financial option. Are you presently an initial-big date homebuyer otherwise seeking to re-finance? Are a fixed-rate or changeable-rates financial right for you? Are you willing to be eligible for Federal Construction Government (FHA), You.S. Department from Agriculture otherwise veteran’s mortgage? Whatever your needs is, the mortgage loan officials are working closely along with you to obtain just the right financial with aggressive costs and lowest- if any-closing-pricing options.

Assist you from homebuying processes. We require one to become due to the fact told that you can when designing choices regarding your mortgage. Use all of our mortgage calculator examine much time-name can cost you and you can calculate monthly obligations. Visit our home Buying 101 self-help guide to realize about the latest homebuying processes, song your progress and also your monetary ducks when you look at the a line. Before you go, start the brand new prequalification processes and you will apply at a keen OCCU financial expert locate your entire questions replied.

Take your novel products under consideration. Just like the credit unions do have more independence than simply financial institutions, we can easily bring far more options to suffice users who will be first-day homeowners otherwise lack antique credit profiles. Not only will we help you so you’re able to generate the credit need, but we can commonly thought unique points which can keeps affected all of our members’ credit ratings previously. That can easily be a genuine advantage for homebuyers who possess the new method for purchase a property but don’t feel the credit score to acquire a vintage financial loan.

Borrowing commitment mortgage loans try increasingly popular given that not-for-profit credit unions can offer professionals one to getting-profit banks only cannot meets. Long, failed to read? We have found an easy research chart showing the difference ranging from a credit partnership financial and you will a mortgage.

Going for a cards partnership to suit your financial

There are many than just 5,000 borrowing unions in the usa, each possesses its own membership requirements. Your qualifications get rely on your area or works, which your boss are, just what industry you operate in, or in which you decided to go to university. Yet not, very credit unions possess significantly expanded its membership requirements over the prior years, making it simpler so you can meet the requirements.

To join OCCU, everything you need to manage is live otherwise work with you to of one’s 67 Oregon and you can Arizona areas i serve. It will require below five full minutes to join up on the internet and end up being an enthusiastic OCCU user. Prior to making people decisions, is a list off what things to discover when selecting a great borrowing from the bank relationship for your mortgage:

- Federally covered: The brand new National Borrowing Union Government (NCUA) has got the exact same protections your Government Put Insurance policies Enterprise (FDIC) offers banking institutions: insurance policies toward dumps up to $250,000.

- Low rates and you can costs: Come across the credit union that can offer https://elitecashadvance.com/payday-loans-ia/hamilton/ the ideal pricing on your home mortgage and you may low- or- no-closing-pricing selection.

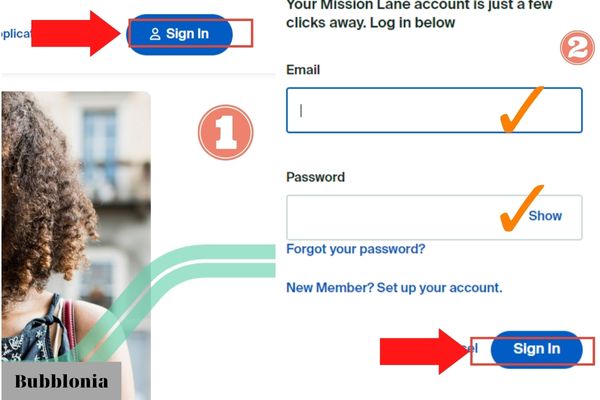

- Powerful electronic financial gadgets: On age easier on line financial, you need to make sure your new borrowing from the bank partnership has actually a keen easy-to-use app (eg MyOCCU On line & Mobile) to analysis banking making online costs at household otherwise on the move.

Need certainly to find out about capital a house that have OCCU? Our mortgage officers are happy to respond to your questions. E mail us today to get your domestic lookup come.

Leave a Reply