It is critical to examine new pricing, terms paydayloancolorado.net/durango, charges, and you can qualification standards various lenders to discover the best complement to suit your particular need.

Will you be purchasing a fixer-higher?

You may want to glance at FHA 203k. It’s also really the only loan we listing that provides home improvements that may be shared into a beneficial homebuyer mortgage. You need to read the guidelines observe if or not you understand the guidelines governing money disbursements. The notion of purchasing one the home of security the 2 you prefer are lower and in the end simpler. Meyer shows you that FHA203k programs are only of use when buying fixes. I might nevertheless highly recommend people examine option financing solutions.

Playing with domestic equity towards the non-domestic expenditures

When you’re mobile funds from a lender so you’re able to a cash-aside lender otherwise mortgage so you’re able to a property collateral mortgage, the money is certainly going to almost any number need. You can pay-off credit card debt, buy a car, repay personal credit card debt and you may carry on a secondary. What exactly do we want? You’ve decided; that’s your own. But purchasing security inside enhancing your house is will an excellent way of enhancing your residence’s value. Purchasing $4000 so you can upgrade a basement is a fantastic capital inside boosting a great household’s worthy of. It is an extremely beneficial financial support together with your home.

Complete the application for the loan processes

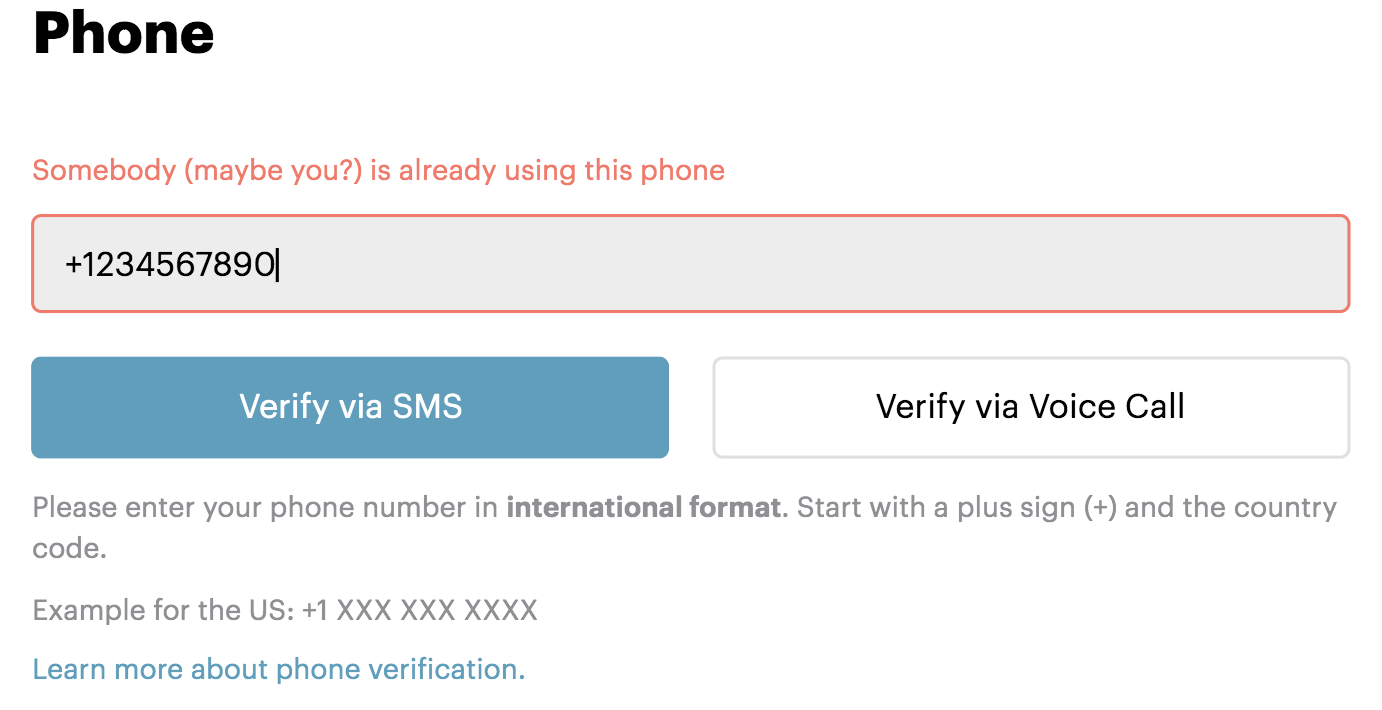

It is possible to complete on line software having financing from the phone, by post otherwise of the calling the local lender personally when your financial will not take on all of them personally. Sometimes their financial application may include both solutions. The credit department may review your application to truly get your possessions analyzed predicated on financing conditions. You’ll end up approved for capital when you yourself have an effective ount away from currency to blow.

When you are in the market for a home improve loan, consider utilizing Hitch in order to clarify the loan app techniques. Hitch now offers a sleek software procedure that will be done entirely on line. With a network from credible loan providers and you will numerous loan alternatives, Hitch can help you get the best mortgage for the certain do-it-yourself means. In addition to, Hitch also provides individualized assistance and guidance about whole process, making sure you’ve got what you really need to build the best choice to suit your unique situation. Start your residence update loan application which have Hitch today to come across how easy it may be to find the funds you would like adjust your house.

Associated Articles:

- Just how to discover your own collateral inside an altering housing market

- Renovations, remodeling, and you will enhancements finance calculator

- Bathroom Building work: Information, Tips and tricks

- How-to Finance Base Solutions

- Discover Do-it-yourself Finance inside the Oregon

- Financial support Your Texas Home improvements: The basics of Home improvement Finance

- Do it yourself Financing within the Las vegas, nevada: All you have to Understand

dos. HELOCs provides a 10-season draw period. Inside mark period, new borrower must make month-to-month minimal repayments, which will equivalent more from (a) $100; or (b) the entire of all the accumulated funds charges or any other charges for the brand new monthly charging course. For the draw months, the fresh new monthly minimal payments may not reduce the a fantastic dominant equilibrium. When you look at the repayment period, the newest borrower must build month-to-month minimal payments, which will equivalent the greater amount of regarding (a) $100; otherwise (b) 1/240th of one’s an excellent harmony after brand new draw months, in addition to most of the accumulated loans charges or any other charges, costs, and you will will set you back. In the installment months, new month-to-month minimum payments might not, for the the amount permitted legally, completely pay off the primary harmony a good on HELOC. At the end of the payment months, new debtor need to pay one remaining a fantastic equilibrium in a single full commission.

Leave a Reply